Integra News The Mortgage Application Process

How does it work?

Before I get started on the mortgage application process, let me just say that once you’ve done it once, you will then become a master!

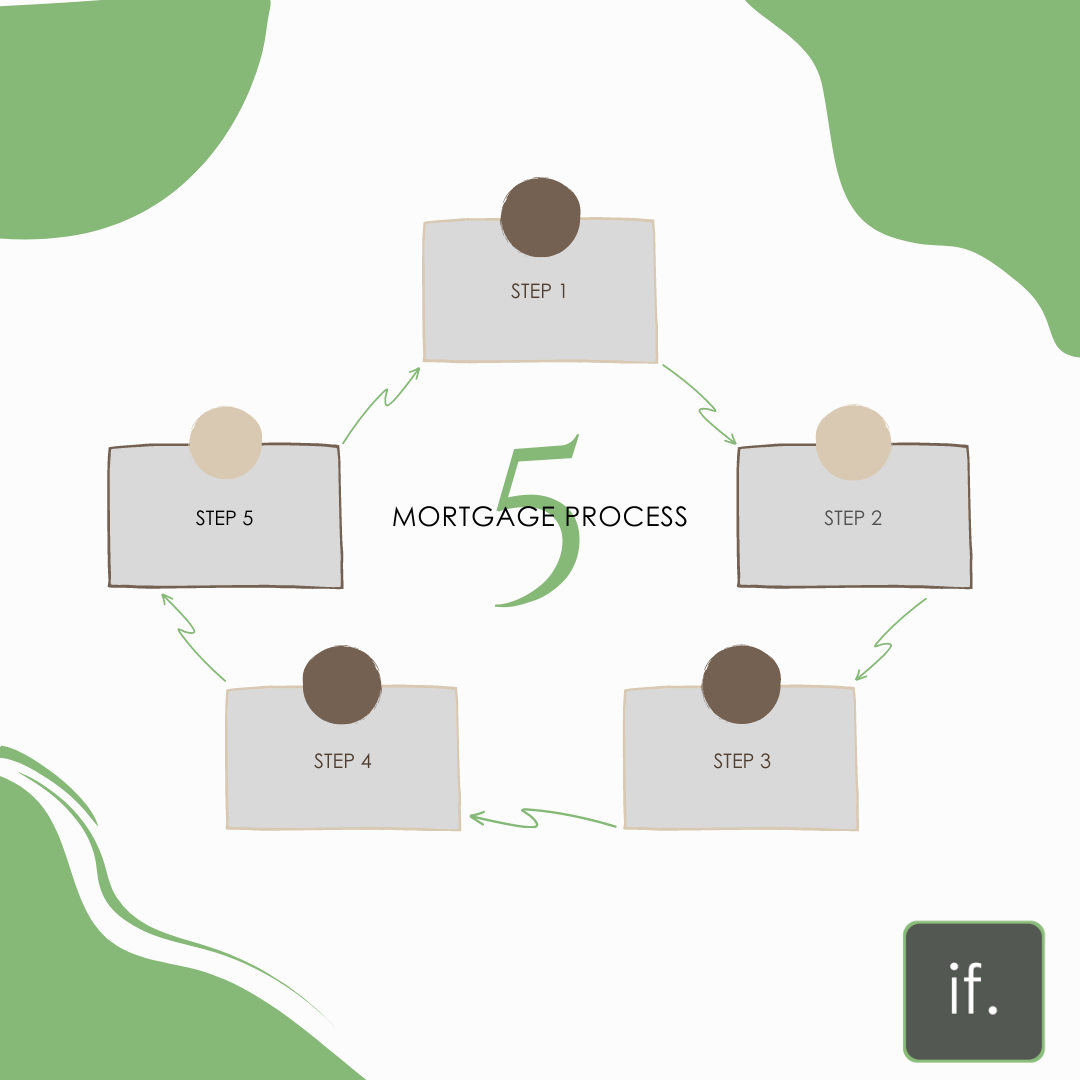

Here are the key stages when applying for a mortgage:

- Step 1: AIP/DIP/MIP (Confused)

Agreement in principle, decision in principle and mortgage in principle. 3 common terms used that all mean the same thing, having a credit check carried out by the mortgage lender to ensure that you are credit worthy and have a clean bill of credit health to give the mortgage lender promise that you can demonstrate you are a safe bet.

This is phase one of your mortgage journey. Once your mortgage adviser has located a suitable mortgage deal for you they will request a batch of documents to support your application such as; proof of identity, proof of address, proof of income, proof of deposit, bank statements and so on and so forth.

The process with most mortgage companies takes around 25 to 30 minutes and the mortgage advisor will require a few details from you to understand a little bit about your history. Typically within 20 to 30 seconds following submission the mortgage lender will provide a response on your credit check and the outcome will be; accept, refer decline.

- Step 2: Submitting your mortgage application

At this stage your mortgage adviser has collated all your documents, completed the full mortgage fact find and where applicable obtained new property details, estate agents details and solicitors details. They will then spend anything up to an hour submitting your mortgage application to the mortgage lender.

- Step 3: Mortgage Underwriting

This is the point at which your application has been submitted and the bank or building society will assign you an underwriter or case handler to review your application to manually assess the risk. They will typically request a standard list of documents at the point of application such as; ID, proof of address and proof of income, however we often see lenders add more to the list once they have viewed the credit profile and application. At this stage they will go through your case with a fine tooth comb and iron out any potential risks they may see with the application. Basically they need to carry out all due diligence checks to ensure that in the event of an audit from the FCA (Financial conduct authority) aka the regulator, that they can prove they have done everything they can to vet their lending risk.

- Step 4: Mortgage Valuation

Mortgage lenders are more often than not offering free basic mortgage valuations on purchase and re-mortgage cases and as a result they will instruct a valuer to call the vendor, estate agent or yourself to arrange to view the property. Because of the ‘free’ element and the fact that lenders want to turn the lending around quickly, they will often instruct the valuer once the application has been submitted. This simply means that they send a request to a panelled valuer who is licensed under RICS (Royal Institute of Chartered Surveyors) to view the security address and make sure its within the lenders criteria for construction type, habitability, and also to ensure the valuation is represented fairly within the mortgage application.

Once the valuation has been carried out the valuer will put together a report and send it to the mortgage lender for review. This report includes basic content about the property such as its condition, size, property type, condition and rebuild value for insurance purposes. If it is a flat they will include comments on the lease and communal access areas.

- Step 5: Mortgage Offer

Once the underwriting has been completed, all paperwork assessed and valuation completed and assessed the lender, if they are happy, will then issue a formal mortgage offer. This is basically and ESIS/KFI (Mortgage illustration), with a fancy letterhead and offer terms and conditions. A copy is sent to your mortgage broker, the acting conveyancer and yourself (The client!).

Upon receipt it is very important that you check the offer document to ensure that the product matches that which you had applied for. Remember, mistakes do happen, after all, we are all only human, so it is important to check this to save any long term issues!

The copy sent to your solicitor/conveyancer is a little bit different to the one received by the mortgage broker and yourself, it will include something called a: mortgage deed or certificate of title. Yes, they are both the same thing, but we don’t like keeping things simple in the financial services industry, do we?! ; )

The COT (Certificate of Title) or mortgage deed will be sent to you generally within 10 days of receipt of your mortgage offer. You are required to sign this whilst being witnessed and then return it to your solicitor/conveyancer. Once they have completed all their relevant legal checks on you and the security address, they will submit this to the mortgage bank or building society and request the mortgage monies to be sent to them in readiness for completion.

So there you have it, a simple 5 step guide of the mortgage process. We have a pretty cool mortgage processing infographic that we share with all our clients that we are happy to provide you with to give you a better visual of how it all works. Just ask one of our staff and they will happily email the information to you.

What do I do next?

Before committing to a mortgage application, speak with a mortgage expert. They ask a lot of questions but it’s all for good reason. In fact it will protect you, your credit report and a wee bit of embarrassment if things aren’t going to way you want them to!

How can Integra Financial help me?

If you have any questions about this blog then feel welcome to contact us via:

Email: enquiries@integraf.co.uk

Or our telephone: 0117 251 0083

Thank you for reading this blog, we hope it was useful to you. If you’d like to keep updated on Integra Financial, why not follow our Instagram and Facebook? Just search for @integrafltd

See you there!