Integra News Latest News

Who are UK Commercial and Development Finance?

Written by Ryan Boyd

Hello all, It has been a while since we published a blog on here. Apologies to all our regular readers! It has been a very busy 12 months since the mini budget announcement in ...

Read More

What is a Mortgage Prisoner?

Written by Ryan Boyd

Not the nicest term to use, do you agree? But, it is pretty true. Having read through some interesting statistics on the FCA website, there are circa 195,000 mortgage borrowe ...

Read More

How much mortgage can I Afford?

Written by Ryan Boyd

How much mortgage can I afford? Did you know that there are almost 41,000 google searches a month asking this very question? Because it is such a commonly asked question ...

Read More

When will interest rates peak?

Written by Ryan Boyd

When will interest rates peak? The mortgage market has seen some radical changes over the past 5 months. The Bank of England has increased to 1%, swap rates (Libor) have rise ...

Read More

The Mortgage Application Process

Written by Ryan Boyd

How does it work? Before I get started on the mortgage application process, let me just say that once you’ve done it once, you will then become a master! Here are the key ...

Read More

How do I compare mortgages?

Written by Ryan Boyd

There are effectively two ways you can compare mortgages. Number 1: Just find the lowest interest rate and get really excited by how low your monthly payments may be. Numb ...

Read More

How does Bridging Finance Work?

Written by Ryan Boyd

We put together a blog for you a number of months ago and thought we would touch on the subject again due to the increased volumes of bridging loan enquiries we have received ...

Read More

High Net Worth mortgages

Written by Ryan Boyd

A commonly held belief is that those with a high income/net worth can easily secure a mortgage with a high street lender, however, it’s not as easy as you may think. Speakin ...

Read More

What are tax overviews and calculations?

Written by Ryan Boyd

Tax calculations (otherwise known as tax computations or SA302) and overviews are documents required by lenders during self-employed clients’ application process. But what ...

Read More

Are Mortgage Advisers worth it?

Written by Ryan Boyd

The short answer is yes! Perhaps you could say we’re a little biased, Mortgage Advice being our profession and all, but speaking to a Mortgage Adviser is a sensible decision ...

Read More

How big is the equity release market today?

Written by Ryan Boyd

In the early years of equity release schemes there were many things that needed evolving to make it the robust product choice that it is today. Back in the embryonic stages of ...

Read More

Why has my mortgage application been declined?

Written by Ryan Boyd

No one likes being rejected – especially when applying for a mortgage. There is a lot of work, time, and emotion that goes into it, right?So, if your application has been de ...

Read More

Is Bristol the new London?

Written by Ryan Boyd

Okay, perhaps “the new London” is a bit of a stretch – but in recent years, Bristol’s leading technology, universities, and range of venues and shops have been recogni ...

Read More

How do I save money?

Written by Ryan Boyd

According to a survey conducted by the FCA (Financial Conduct Authority) in 2021, 52% of adults in the UK are considered financially vulnerable. The COVID-19 pandemic is massi ...

Read More

How could equity release help you?

Written by Ryan Boyd

Equity release is a way to unlock some of the tax-free cash tied up in the value of your home. It’s available for homeowners aged 55 and over, and the money you release can ...

Read More

Buying/selling in 2022?

Written by Ryan Boyd

With just 2 days left in 2021, it’s time we start preparing for 2022! And if you are looking to buy or sell a home in 2022, that means reading up on hints and tips from hous ...

Read More

What does the recent Bank of England base rate rise mean for you?

Written by Ryan Boyd

On December 16th, the Bank of England announced a rise in the base rate. Specifically, the base rate went from 0.10% to 0.25%. You might be thinking, “0.25% is still a tiny ...

Read More

Will Housing market crash in 2022?

Written by Ryan Boyd

Being in this industry for 14 years, I have heard many clients ask, or certainly fear, that house prices might crash at some point. So, they either delay any action or end up ...

Read More

Am I ready to buy a house?

Written by Ryan Boyd

How do you know if you are ready to buy a house? Whether you are a first-time buyer or a next-time buyer, this is the question everyone wants the answers to, right? With tha ...

Read More

Should I review my mortgage?

Written by Ryan Boyd

It’s the most wonderful (and expensive) time of the year! What with presents, food, AND decorations… Suffice to say Christmastime hits the bank hard. The last thing you’ ...

Read More

Why are lenders so reluctant to repossess?

Written by Ryan Boyd

Clients often ask us: “Why won’t lenders let me borrow money when they could just repossess my property if I don’t make payments?” The truth is that repossession is a ...

Read More

When should I speak to a mortgage adviser?

Written by Ryan Boyd

The short answer would be “the sooner, the better”! Buyers If you are a buyer, then you will find that many estate agents want you to be qualified before they allow you ...

Read More

Are mortgage rates set to rise?

Written by Ryan Boyd

Eyebrows are being raised across the UK over the Bank of England’s current base rate of 0.10%. Whilst this number looks ideal to buyers, this rate seems too good to be true ...

Read More

How can we make a change?

Written by Ryan Boyd

As COP26 has made clear, we need to act now and combat the climate crisis. World leaders came together to discuss how we can reduce our carbon emissions across the globe and e ...

Read More

What do I need to know about bridging loans?

Written by Ryan Boyd

A bridging loan is a short-term loan that typically needs to be repaid within 12 – 18 months. Unlike mainstream mortgage lending, bridging finance lenders pay more focus to ...

Read More

Struggling to find a property?

Written by Ryan Boyd

In recent months, our Advisers have noticed a pattern – many clients seem to be struggling to find property on the market, especially between the £700,000 to £1,500,000 br ...

Read More

What are the major benefits of having a strong administration support for you and your Adviser?

Written by Ryan Boyd

At Integra Financial Ltd, we are fortunate enough to have a CeMAP qualified administration team to help our Advisers throughout our clients’ journeys with us. We know that o ...

Read More

What is commercial finance?

Written by Ryan Boyd

Very simply commercial mortgages are secured loans against properties that are intended to be used for commercial use. This can be to purchase a property for your own business ...

Read More

Surge of remortgages expected in 2022

Written by Ryan Boyd

2022 is being anticipated by the mortgage market experts as the year of the remortgage boom… But why is this? In 2016, interest rates were at a pretty extreme low in compar ...

Read More

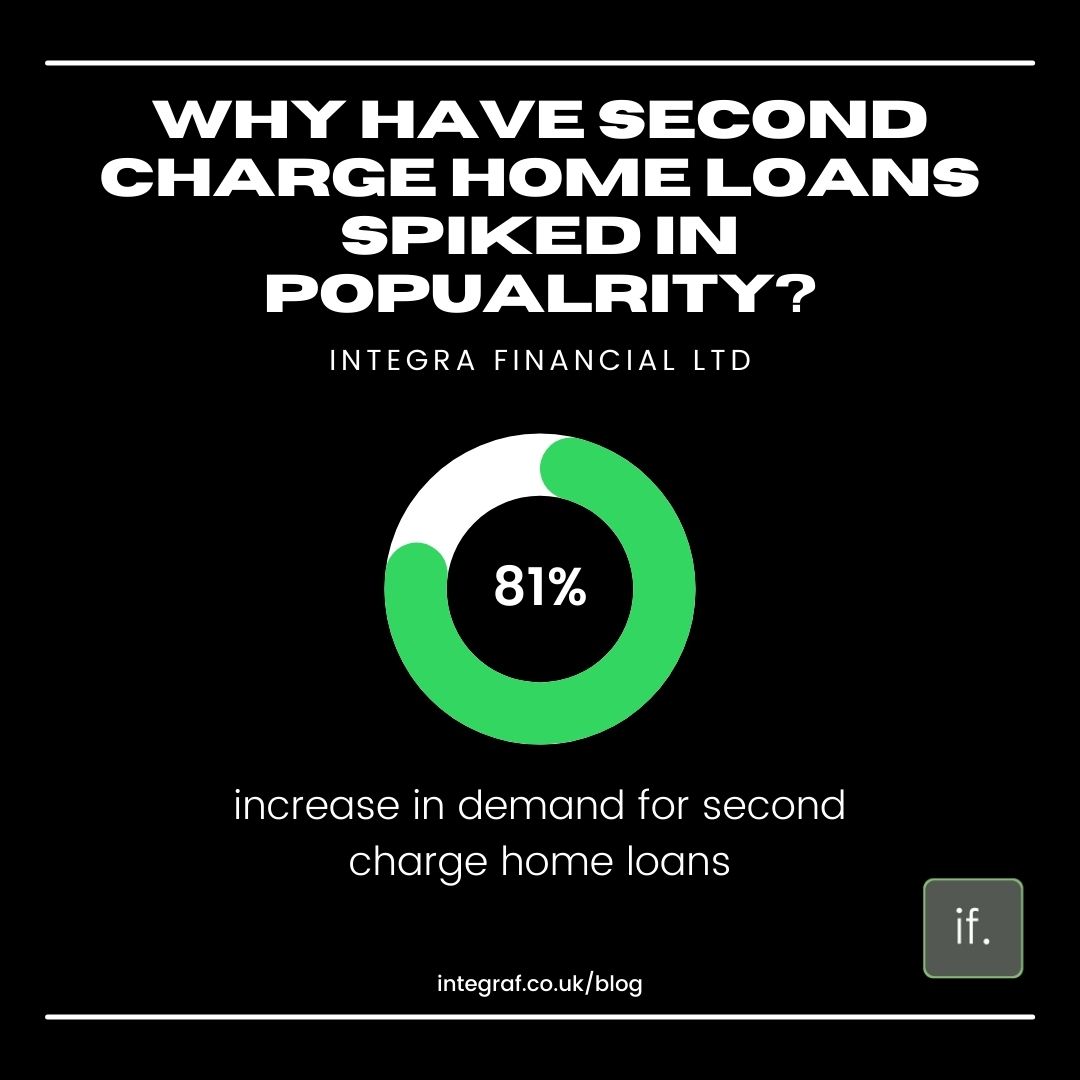

Why have second charge home loans spiked in popularity?

Written by Ryan Boyd

When I started working at Integra, the first bit of content I ever wrote for this brilliant company was our “What are second charge home loans?” blog. So I must say, I am ...

Read More

Why Integra Financial Ltd are a highly commended small broker

Written by Ryan Boyd

At Integra Financial, each year we are grateful to be shortlisted for the award of Best Small Broker in the Mortgage Strategy Awards. We were awarded the Highly Commended Smal ...

Read More

Britain's lowest EVER mortgage rate launches

Written by Ryan Boyd

2021 has been the year for breaking mortgage records! In March, the record for most money borrowed for mortgages was broken for the first time in 28 years. In June, the record ...

Read More

What do I need to bring to my mortgage appointment?

Written by Ryan Boyd

Try as we might to make them as casual and relaxed as possible, we know that mortgage appointments can be daunting (especially if you’re a first-time buyer!). We will take a ...

Read More

Save money (and the planet!) with Green Mortgages

Written by Ryan Boyd

A number of lenders are rewarding clients that are purchasing or re-mortgaging energy efficient homes by offering lower rates on their mortgages. If you are purchasing a UK pr ...

Read More

7 tips for finding your dream property

Written by Ryan Boyd

Purchasing property is undoubtedly the biggest financial decision you will ever make – and so it’s crucial that you find one that’s within your price range and meets you ...

Read More

Why is Equity Release so popular?

Written by Ryan Boyd

Equity Release has risen in popularity over the past 10 years or so thanks to a resurgence in consumer confidence with the product. Not only are there more safeguards in place ...

Read More

Jargon Buster!

Written by Ryan Boyd

At Integra Financial Ltd, we want to live up to our slogan, “Finance Made Easy”. We know that the jargon the industry uses can be a little confusing, especially for ...

Read More

How much is it worth?

Written by Ryan Boyd

A question we get asked a lot is, how much is my house worth? It’s also a question we ask every client, as we need to know this for the purpose of recommending the most su ...

Read More

Early Repayment Charges

Written by Ryan Boyd

At Integra, we’ve had a sea of clients ask us about early repayment penalties, particularly clients that want to re-mortgage or are moving house. So, we decided, why not ans ...

Read More

Prepping your Property?

Written by Ryan Boyd

Want your house sold fast? Ready to put your property on the market, but don’t know how to appeal to buyers? You’ve come to the right blog! Here 5 steps you can take to pr ...

Read More

How much life insurance do I need?

Written by Ryan Boyd

At Integra, we know our customers are asking themselves this question. Whilst there may not be a silver bullet answer to give, I think we can apply some simple logic to help ...

Read More

Want to get your interest down to 0%?

Written by Ryan Boyd

Offset Mortgages Blog The Directors here at Integra Financial started advising around 18 years ago, and in their earlier years of advising, Offset Mortgages were immensely po ...

Read More

Advice or Price?

Written by Ryan Boyd

Who Needs Your Advice? Good question! If life insurance is compared by various online services why would you bother speaking to a broker? To answer this question is to unde ...

Read More

Contractor Mortgages

Written by Ryan Boyd

So, what is a contractor mortgage? A contractor mortgage is a mortgage with bespoke lending criteria that lenders will offer to people on a fixed-term contract. A traditional ...

Read More

Do you 'Trust' me?

Written by Ryan Boyd

Let’s talk about Trusts! Will Your Life Cover Cost Your Family £000’s When You Die? Is your life cover written in trust? I bet it isn’t! I say that because accordin ...

Read More

When should You re-mortgage?

Written by Ryan Boyd

Remortgaging is the point when your current mortgage deal as come to or is coming to an end and you need to replace it with a new deal. Remortgaging can save you from higher s ...

Read More

How Do I Protect My Business?

Written by Ryan Boyd

Get Your Own House In Order First! At Integra Financial we take integrity so seriously, we named our business after it! So it made sense that when we began offering advice t ...

Read More

Get To Know Us!

Written by Ryan Boyd

At Integra Financial, we value client relationships very highly and we thought, we know so much about our clients, so why don’t we let our clients know more about us? Me H ...

Read More

5 Tips For Buying a Property

Written by Ryan Boyd

When you decide to purchase property in the UK, you’ll need to talk to a number of people, go through a multitude of checks and maybe even face rejection before you get the ...

Read More

What is Equity Release?

Written by Ryan Boyd

Equity release has spiked in popularity over the last 11 years, but why? What is so great about equity release? Well, read on to find out everything you need to know! Equity ...

Read More

How to put life cover on expenses

Written by Ryan Boyd

Can I put it on expenses? Is it tax deductible? Perhaps the most commonly asked questions by business owners. And why not? We could be talking about substantial savings to a ...

Read More

Here are 7 Bridging Finance facts for you to consider

Written by Ryan Boyd

A bridging loan is a flexible, short-term loan that is particularly useful in many situations such as breaking a chain to buy a property, renovating a property to make it ap ...

Read More

A Lottery Win could cripple your Business

Written by Ryan Boyd

I was recently reading a post on LinkedIn discussing the importance of businesses taking Key Person Insurance. Right up my street of course! Whilst interested in the article ...

Read More

2021 Breaking Records in Housing Industry

Written by Ryan Boyd

The Stamp Duty Holiday has caused a frenzy in the housing industry! March 2021 broke the record for most money borrowed for mortgages in 28 years, due to UK homeowners scrambl ...

Read More

Has COVID-19 left businesses in the dark?

Written by Ryan Boyd

It doesn’t take a genius to figure that many small and medium sized businesses will be struggling right now. Many will have seen their capacity to trade restricted and even ...

Read More

Why do I need a conveyancer/solicitor?

Written by Ryan Boyd

Have you ever wondered why you need to hire a conveyancer/solicitor during the house buying process? Mortgage advisors cover paperwork and getting to the mortgage offer, so wh ...

Read More

New government mortgage scheme!

Written by Ryan Boyd

As we all know, the housing sector has taken a hit during the pandemic. Having strangers come and view your house, as well as viewing other people’s houses, whilst a viral d ...

Read More

It won't happen to me! (Business Protection)

Written by Ryan Boyd

We are all guilty of this to some extent, right? Where does this state of mind come from? We see tragic events happen to other people from all over the world yet somehow we ru ...

Read More

What the Stamp Duty Holiday means for You (Residential)

Written by Ryan Boyd

At the beginning of March 2021, it was announced that the stamp duty holiday has been extended until the end of June 2021. However, the stamp duty holiday has caused confusion ...

Read More

What are second charge home loans?

Written by Ryan Boyd

If you are struggling to obtain additional borrowing with your current mortgage lender, perhaps due to affordability, or maybe even credit rating, then you may be considering ...

Read More

Why have 95% mortgages of vanished?

Written by Ryan Boyd

It’s taken some time however, April 2021 will see the very welcome return of 95% mortgages to the UK market. This is such an important step as it makes the market that much ...

Read More

Can mortgage calculators be trusted?

Written by Ryan Boyd

What is the question everybody needing a mortgage wants to know? You got it, “how much can I borrow?” It used to be a lot easier Years ago the answer was much more st ...

Read More

How do I get a mortgage?

Written by Ryan Boyd

So you want to get a mortgage. What are the mistakes that are all to easily made that could see your application miss the mark? Avoid these and you will maximise your chances ...

Read More

Help for first time buyers

Written by Ryan Boyd

First Time Buyers Buying for the first time can be very daunting, here are a few steps to help you along the way. Speak to a mortgage adviser or maybe even a few ...

Read More

What are ex-pat Mortgages?

Written by Ryan Boyd

At Integra Financial Ltd we often get clients who are UK nationals living abroad, but wish to purchase or re-mortgage a property in the UK. Whilst these types of mortgages a ...

Read More